The Missing Link Between Your Business and Scalable Success

Every business faces roadblocks. Whether it’s securing funding, lowering costs, staying compliant, or streamlining operations, these challenges limit growth and profitability. But what if you could remove these obstacles with proven solutions from industry-leading providers?Welcome to Efficiency Bridge—where we connect businesses like yours to the most effective strategies, tools, and financial solutions, all backed by our exclusive network of trusted partners. Below, we dive deeper into how our solutions HeadlinesolveHeadline real-world business challenges in today’s evolving economic landscape.

Financial Growth & Funding Solutions

Explore Available Tax Credit Eligibility

Are You Missing Out on Valuable Tax Credits Without Even Knowing It?

Imagine running your business for years, reinvesting every dollar, only to find out that the government had funds set aside to help you—and you never claimed them. Does that sound frustrating? It should. Yet, countless businesses miss out on millions in tax credits every year simply because they don’t know they qualify. Have you checked what credits your business is entitled to? What could your company do with an extra $100K, $500K, or even $1M+ in unclaimed funds?

Explore Available Tax Credit Eligibility

Unlock Hidden Tax Credits & Reduce Your Tax Burden

Every year, businesses leave millions of dollars in unclaimed tax credits simply because they aren’t aware they qualify. Whether you’re recovering payroll-based credits, research incentives, or industry-specific tax savings, our tax credit specialists ensure you maximize every available opportunity without the hassle of navigating complex tax laws.

Through our partnership withindustry-leading tax credit experts, we offer a comprehensive approach to uncovering and claiming financial benefits for your business.

Secure Friction Free Funding

The Capital You Need, When You Need It

Get the Capital You Need—Fast and Hassle-FreeOpportunities do not wait, and neither should you. Whether it is expansion, equipment, or marketing, securing funds quickly can be the difference between growth and stagnation.Traditional loans require weeks of paperwork, high credit scores, and personal collateral. But what if you could access up to two million dollars in funding within twenty-four hours without the hassle?

With our alternative lending partner's platform, you can apply in minutes with a simple process, qualify based on business performance rather than just a credit score, secure up to two million dollars with no collateral required, and receive funding in as little as twenty-four hours. How much faster could your business grow if the capital for that opportunity was available tomorrow? Don't let the lack of funds slow you down. Take control of your business's future today.

Opportunities won’t wait. Neither should you!

Business Credit & Corporate Funding Platform

Are You Tired of Relying on Personal Credit for Business Growth?

Imagine this, You’ve built your business from the ground up. You’ve invested your time, energy, and personal savings. But when it’s time to scale—whether that means securing a new office, purchasing equipment, or expanding operations—you hit a wall. The bank tells you, “We need a personal guarantee.” Your credit limits aren’t high enough. Interest rates are sky-high because your business isn’t truly recognized as "fundable"

Does this sound familiar? If so, you're not alone. Over 80% of small businesses struggle to secure funding because they lack proper business credit. Most owners are forced to use personal credit cards and loans, putting their personal assets at risk. But what if your business could stand on its own financially—without tying your personal credit to it? With Fundable 360, you gain access to a lifetime membership that positions your business for long-term funding success. Establish strong business credit, secure high-limit lines of credit, and access funding without tying your personal assets to it.

Is Your Paymet Processing Costing You More Than It Should?

Reduce Fees, Protect Transactions & Improve Cash Flow

Many businesses unknowingly overpay thousands in transaction feesevery year. Hidden charges, high processing rates, and outdated systemscut into profits—yet most business owners never take the time to review their merchant account.

That’s why we’ve partnered with a top-rated payment processing expertto help businesses uncover savings, improve cash flow, and ensure they’re getting the best rates available

This industry-leading network service provider has:

15+ years of experience in helping businesses lower their processing fees

An A+ rating with the Better Business Bureau, recognized for exceptional service and transparency

Thousands of 5-star reviews from business owners who have seen significant savings

Recognition from major publications like The New York Times, highlighting their role in improving small business financial operations

Cost Reduction & Operational Efficiency

Are High Energy Bills Eating Into Your Profits?

Energy costs are rising, and businesses are paying the price. Whether you are in a deregulated energy market or not, the reality is that every business can benefit from reducing operational energy expenses. The key is knowing where to look.

For businesses in deregulated states, switching energy suppliers can dramatically reduce costs by securing lower, fixed-rate contracts. Many businesses save up to forty percent just by making a simple switch. In regulated markets, strategic energy efficiency improvements—such as solar adoption, LED retrofits, and energy management solutions—help businesses take control of their long-term costs while reducing dependency on fluctuating utility rates.

Think about how much of your revenue is lost each month to energy expenses. What could your business achieve if a portion of that cost was reinvested into growth, hiring, or innovation?With our tailored energy solutions, businesses of all sizes can reduce expenses, increase profitability, and improve sustainability. Whether it’s switching energy suppliers, integrating solar solutions, or implementing smarter energy management, there are ways to cut costs without disrupting your operations.Are you currently overpaying on energy costs? How much money are you leaving on the table?

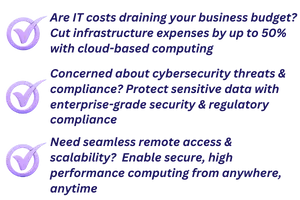

What Would It mean for Your Business If You Could Secure, Cost-Efficient Cloud Computing?

Businesses today face a growing challenge—balancing the need for top-tier cybersecurity, compliance, and seamless operations while keeping IT costs under control. Traditional IT infrastructures are expensive, inefficient and vulnerable to attacks. The question is, how much is your business overspending while remaining at risk?

Most companies assume they need costly on-premise servers, dedicated IT teams, expensive hardware upgrades to maintain security and compliance.

But what if there was a way to enhance security, streamline operations, and reduce IT expenses by up to 50%—all at the same time? Businesses can move beyond outdated, high-maintenance IT infrastructures and adopt a fully managed cloud computing solution that delivers Enterprise-level security to prevent cyber threats before they happen,

Seamless cloud migration that eliminates the need for expensive hardware upgrades Compliance-ready infrastructure to protect against fines and regulatory violations

Scalable, cost-efficient IT management that can reduce IT costs by up to 50%

Think about how much your business currently spends on IT infrastructure, security, and compliance.

What could you reinvest into growth if those costs were significantly reduced?

More importantly, how much would a security breach or system failure cost your business?

The future of business IT is secure, cost-effective, and cloud-based. Are you ready to make the switch?

Automated ADA Compliance

Most business owners do not realize that one in five Americans—over 60 million people—live with a disability. Yet, many websites remain inaccessible to these users, creating unnecessary barriers and excluding a significant customer base. Beyond the ethical responsibility, non-compliant websites are also at risk of costly lawsuits and fines that could damage both finances and reputation.Did you know?

ADA-related lawsuits have increased by over 300% in the last five years, targeting businesses of all sizes. Companies that fail to meet accessibility standards face legal penalties, averaging $50,000 or more per settlement. Google favors accessible websites in search rankings, improving SEO and increasing visibility.Studies show that businesses that invest in accessibility see a 12-15% increase in customer engagement and conversion rates.

With Website Guardian, ensuring ADA compliance is simple, automated, and beneficial to your business in multiple ways. Automated compliance monitoring to prevent legal risks before they arise. Enhanced search engine rankings by meeting Google's accessibility best practices. A seamless browsing experience for all users, increasing potential customers and engagement. Protection from legal liabilities, helping you avoid lawsuits and government fines. A commitment to inclusivity, positioning your business as a leader in ethical and customer-focused service.

Think about your industry. If your business is in healthcare, finance, legal services, or another hughly regulated field, ADA compliance is not just a best practice—it is a requirement. Even outside of highly regulated industries, failure to comply with accessibility laws can put your business at risk. Recent lawsuits against major retailers, banks, and restaurants highlight how ADA compliance is becoming a standard expectation, not an optional feature. The question is, will your business take action before it becomes a problem? Are you proactively protecting your business, improving customer experience, and increasing your online visibility? Or are you waiting until it's too late?

It has never been easier to ensure your website is ADA Compliant

Get Started Today!

Workforce Optimization & HR Solutions

Maximize Employee Benefits While Reducing Employer Costs

Why Choose Supplemental Group Health Plans?

Providing employees with comprehensive health benefits is a key factor in attracting and retaining top talent. However, traditional group health plans can be expensive and inflexible.With Supplemental Group Health Plans offered through Trumark Health & Quantum, businesses can provide employees with customized, tax-advantaged benefits while lowering overall healthcare costs.

Lower Employer Payroll Taxes – Reduce taxable wages while offering valuable employee benefits.

Increase Employee Take-Home Pay – Employees save on pre-tax medical expenses and dependent care.

Compliant & Flexible – Section 125 Cafeteria Plans and tailored benefit structures ensure IRS compliance while giving employees more choices.

Results of Enhancing Employee Group Benefit Options

✔ Reduce employer healthcare costs while improving employee satisfaction

✔ Avoid rising group insurance premiums by integrating cost-effective supplemental plans

✔ Improve retention and recruitment with attractive benefits packages

Is Your Business Maximizing The Potential of Employee Benefits ?

Many businesses overpay on healthcare without realizing how supplemental group health plans can create significant cost savings while providing employees with valuable coverage options.Find out how your business can lower costs and enhance employee benefits today.structures ensure IRS compliance while giving employees more choices.

Full Human Resources Management

Why Choose A Full HR Management Solution?Managing HR internally can be time-consuming, complex, and costly—especially when navigating compliance risks, payroll processing, and employee benefits administration. Without the right system in place, businesses risk legal penalties, inefficiencies and high employee turnover. With Full HR Management Solutions, businesses can automate, outsource, and optimize workforce operations—allowing owners and leadership teams to focus on growth.

Is Your HR System Holding Your Business Back From Progress?

Many businesses struggle with HR inefficiencies and compliance risks, leading to lost time, higher expenses, and employee dissatisfaction. Insperity’s Full HR Management solutions provide a scalable and cost-effective way to handle workforce operations without the administrative stress.

Comprehensive HR Services Included

Payroll & Benefits Administratiom

Ensure timely payroll processing, tax filings, and benefits management without manual effort

HR Compliance & Risk Management

Navigate employment laws, wage regulations, and workplace policies with expert-backed HR solutions

Employee Onboarding & Performance Tracking

Improve hiring, training, and workforce development with structured HR support

Workplace Policies & Employee Relations

Foster a positive work culture while resolving HR issues efficiently

Customer Acquisition & Business Growth Services

Increase Orders & Streamline Your Delivery Operations

Many businesses lose revenue to high third-party platform fees while struggling to scale delivery services efficiently. Managing in-house drivers can be costly, and relying on external services limits control over customer relationships, branding, and profitability.

What if your business could increase order volume, reduce costs, and streamline deliveries without the burden of third-party commissions? A fully optimized system allows businesses to retain more revenue, leverage on-demand drivers, and improve customer satisfaction through faster, more reliable service.

With a streamlined approach, businesses can scale delivery without increasing operational costs, gain full visibility into logistics, and create a seamless ordering experience that strengthens customer loyalty. Instead of losing revenue to inefficiencies, businesses that take control of their delivery operations see stronger margins, repeat customers, and a more sustainable model for growth.

Is your business maximizing its delivery potential, or is it still losing profit to unnecessary fees? A smarter approach to delivery can reduce costs, increase efficiency, and help your business scale profitably.

Enhance Customer Engagement and Automate Your Sales Process

Many businesses struggle with converting leads into customers due to inconsistent messaging, ineffective follow-ups, and time-consuming sales presentations. Prospects often lose interest when information is unclear, overwhelming, or not delivered in an engaging way. Traditional sales methods require significant time and effort, yet many businesses still face low conversion rates and missed opportunities.

What if your business could deliver a compelling, interactive presentation to every prospect without needing a live salesperson every time? What if potential customers could engage with your message at their convenience, with a personalized experience that increases interest and conversions?

A fully automated sales presentation system allows businesses to create a structured, high-impact message that guides prospects through the decision-making process. Instead of relying on manual follow-ups, businesses can present information in an interactive and engaging way, leading to higher retention, better understanding, and more conversions.

With this solution, businesses can ensure that every prospect receives the same clear and effective message, tailored to their needs and interests. Automating sales presentations reduces time spent on repetitive explanations, increases scalability, and allows sales teams to focus on closing deals instead of repeating the same pitch.

Are your prospects receiving a clear and engaging presentation that moves them toward a decision? Businesses that optimize their sales process with automation see higher conversion rates, improved customer engagement, and more efficient use of time and resources. Taking control of how prospects experience your message could be the key to accelerating business growth.

We Are Leveling the Playing Field for Small & Mid-Sized Businesses

Fortune 500 companies have long had access to exclusive financial advantages, cost-saving strategies, and operational efficiencies. But small and mid-sized businesses—the backbone of the economy—are often left struggling with rising costs, limited access to capital, and outdated processes. Efficiency Bridge delivers enterprise-grade solutions in a way that is affordable, scalable, and designed for business owners who don’t have time to waste.

Not Sure Where to Start? Let’s Find the Right Solution for You!

Take a quick, assessment to get a personalized efficiency analysis based on your unique situation. Simply answer a few questions, and our Efficiency Bridge team will provide tailored recommendations to help you optimize operations, reduce costs, and unlock new opportunities.

Start Your Free Efficiency Assessment Now!

© Efficiency Bridge, a subsidiary of Velocity Group Partners LLC – All Rights Reserved.

Business Hours: Monday-Friday 10:00 AM - 6:00 PM

75 S BROADWAY FL 4 WHITE PLAINS, NY 10601

(845) 456-8412